Loading

Get Ct 941

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 941 online

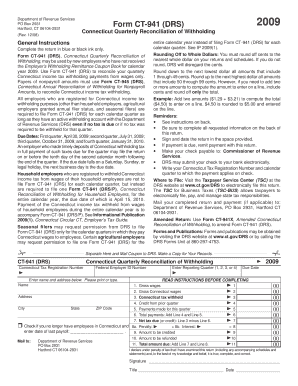

Filling out the Ct 941 form online can be straightforward with the right guidance. This guide offers step-by-step instructions tailored to help you effectively complete the Connecticut Quarterly Reconciliation of Withholding.

Follow the steps to successfully complete the Ct 941 form.

- Press the ‘Get Form’ button to obtain the Ct 941 form and open it in your preferred document editor.

- Begin by entering your Connecticut Tax Registration Number and Federal Employer ID Number in the designated fields.

- Indicate the reporting quarter by entering '1', '2', '3', or '4' in the appropriate section.

- In the gross wages section, enter the total amount of wages paid during the quarter for federal income tax withholding purposes.

- Input the total amount of Connecticut wages paid during that quarter, which includes wages paid to both residents and nonresidents according to the guidelines.

- Record the total amount of Connecticut income tax withheld on wages during the quarter.

- Enter any credits available from the prior quarter in the designated field.

- Sum all payments made for the current quarter and input this total.

- Calculate the total payments by adding the amount from the prior quarter credit and the current quarter payments.

- Determine the net tax due by subtracting the total payments from the total withheld amount.

- Complete the penalty and interest sections if applicable, and ensure to calculate the total amount due.

- Lastly, sign and date the form in the appropriate section and save any changes.

- You can download, print, or share the filled form as necessary.

Start completing your Ct 941 document online today for a smooth filing experience.

Information you report on Form 941 includes wages paid to employees, reported tips, federal income taxes withheld, Social Security and Medicare taxes (both employee and employer portions), and additional taxes withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.