Loading

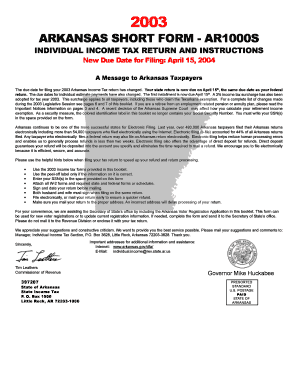

Get New Due Date For Filing: April 15, 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Due Date For Filing: April 15, 2004 online

This guide provides a clear, step-by-step approach to filling out the New Due Date For Filing: April 15, 2004 form online. Designed for users of all experience levels, this resource will help ensure your form is completed accurately and efficiently.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your browser.

- Review all instructions provided in the form. Familiarize yourself with the due date of April 15, 2004, and the associated penalties for late filing.

- Enter your personal information, including your full name and Social Security Number in the designated fields. Make sure your SSN is accurate to avoid processing delays.

- Fill in your filing status. Select one that appropriately describes your circumstances, such as Single, Married Filing Jointly, or Head of Household.

- Input your total income from all sources. This includes wages, salaries, tips, interest, and dividends, attaching W-2 forms as necessary.

- If applicable, report any standard deductions or credits you wish to claim. This may influence your total taxable income.

- Double-check all entries for accuracy before proceeding. Look for discrepancies in your income or additional deductions.

- Once you have filled out all required fields, you can choose to save changes, download a copy of the completed form, or print it directly for mailing.

- If you prefer, you may complete your filing electronically. Ensure that all necessary documentation is attached, and choose your preferred method of submission.

- Finally, confirm the status of your submission and keep a record of any confirmation numbers provided to you during the process.

Complete your documents online today to ensure timely filing and avoid any penalties.

Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people usually have to make quarterly estimated tax payments are pre-set dates throughout the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.