Loading

Get 2011 Form Il 1000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form IL 1000 online

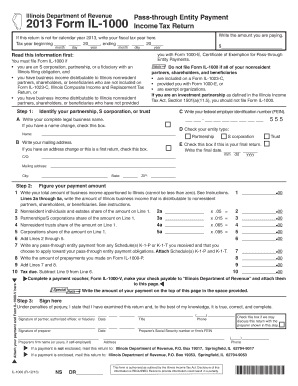

Filling out the 2011 Form IL 1000 is an essential step for S corporations, partnerships, or fiduciaries with an Illinois filing obligation. This guide provides a clear and supportive walkthrough to help users complete the form accurately and efficiently online.

Follow the steps to fill out the 2011 Form IL 1000 successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your complete legal business name in the designated field. If your business name has changed, check the corresponding box.

- Provide your federal employer identification number (FEIN) in the next field.

- Indicate your mailing address, ensuring you include all relevant details. If you have changed your address or this is your first return, check the appropriate box.

- Identify your entity type by checking one of the following options: Partnership, S corporation, or Trust.

- In the payment amount section, write the total amount of business income apportioned to Illinois. Use the given lines to indicate amounts of distributable Illinois business income to nonresident partners, shareholders, or beneficiaries as directed.

- Calculate any pass-through entity payments from any Schedule(s) K-1-P or K-1-T you received and choose to apply toward your payment obligations.

- Complete the payment voucher Form IL-1000-V, ensuring that you write the amount of your payment on the top of the Form IL 1000.

- Sign the form in the designated area, indicating that you have filled it out truthfully and completely. Include your title and the date of signing.

- Select if the preparer may discuss the return by checking the box if applicable and providing preparer's details.

- Finally, review the form for accuracy and save changes, download, or print it as needed before submission.

Complete your documents online today to ensure timely and efficient processing.

Related links form

While Illinois does recognize the federal S election, it nevertheless requires Illinois S corporations to pay the personal property replacement tax at a rate of 1.5% of net income, and, as Illinois corporations, the annual corporation franchise tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.