Loading

Get Form O 88 Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form O 88 Ct online

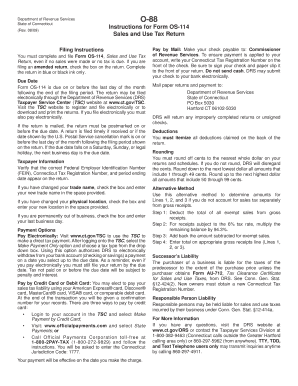

Filling out the Form O 88 Ct accurately is essential for compliance with the sales and use tax laws in Connecticut. This guide provides step-by-step instructions to help you through the online filing process, ensuring that all necessary information is completed correctly.

Follow the steps to fill out the Form O 88 Ct online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the taxpayer information section, ensuring that your Federal Employer Identification Number (FEIN), Connecticut Tax Registration Number, and period ending date are correct. If you have changed your trade name or physical location, indicate this by checking the appropriate boxes and providing the required new information.

- In the payment options section, choose your preferred method to remit payment electronically or by mail. Provide any required information for the selected payment method.

- Move on to the deductions section, itemizing all deductions on the back of the return, as required. Remember to round off cents to the nearest whole dollar when entering amounts.

- Fill out lines 1 through 6 with the total gross receipts, gross purchases, and lease or rental payments as applicable. Carefully refer to the detailed instructions for each line to ensure accurate reporting.

- If applicable, complete the amended return section by entering the relevant amounts and calculations as instructed.

- After completing all necessary sections, carefully review the entire form for accuracy. Make any necessary corrections.

- Upon final review, you can save your changes, download, print, or share the completed form as needed.

Complete your Form O 88 Ct online today to ensure timely compliance with your tax obligations.

The sales tax rate of 6.35% applies to the retail sale of most goods. Personal watercraft such as jet skis. Vessels propelled solely by paddles or oars, and vessels less than 19 ½ feet in length that are not motorboats, are not required to be registered with DMV and are not eligible for the reduced 2.99% tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.