Loading

Get Substitute W 9 For Oregon State University Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Substitute W 9 For Oregon State University Form online

This guide provides clear, step-by-step instructions for completing the Substitute W 9 For Oregon State University Form online. By following these steps, you will ensure that your submission is accurate and compliant with the requirements set by Oregon State University.

Follow the steps to accurately complete the Substitute W 9 form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

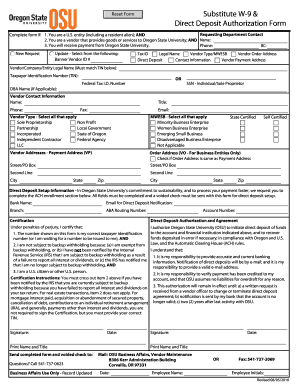

- Select whether you are submitting a New Request or an Update. If you are updating, please provide your Vendor ID Number if known.

- Enter your entity's Legal Name exactly as it appears on your IRS documents along with the corresponding Taxpayer ID Number.

- If your entity operates under a 'Doing Business As' (DBA) name, enter it in the DBA field; otherwise, leave this field blank.

- Provide your entity's Contact Information, including name, phone number, title, fax number, and email.

- Select all relevant options for the Vendor Type and MWESB status sections.

- Fill in your entity's Payment Address and Order Address. If the Order Address is the same as your Payment Address, check the corresponding box.

- For direct deposit setup, input your bank information, specifying whether it is a savings or checking account. Note that foreign banks are not permitted.

- Include a voided check to verify the account for direct deposit.

- Ensure that a company officer signs the W-9 Certification and prints their name and title beneath the signature.

- A company officer must also sign the Direct Deposit Authorization and Agreement, printing their name and title below the signature.

- Send the completed form along with the voided check to the designated address provided at the bottom of the form.

Complete the Substitute W 9 Form online to ensure timely processing of your payments.

What happens if I'm asked to complete Form W9 and I'm not a US person? Form W9 is intended for US persons, as explained in question 2. The equivalent form that applies to non-US persons is W8-BEN (for individuals) and W8-BEN-E (for entities).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.