Loading

Get Sc1065 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC1065 2012 Form online

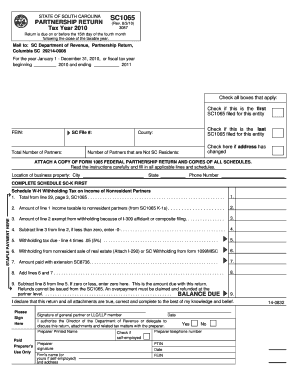

The SC1065 2012 Form is a crucial document for partnerships operating in South Carolina. This guide will provide you with a clear, step-by-step process for filling out the form online, ensuring that you navigate each section effectively and submit your return accurately.

Follow the steps to fill out the SC1065 2012 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by reviewing the general information at the top of the form. Specify the tax year and ensure that you note the due date, which is the 15th day of the fourth month following the end of the taxable year.

- Enter the entity’s FEIN and SC File Number. Indicate the total number of partners and check any relevant boxes, such as whether this is the first or last SC1065 filed by the entity. If the address has changed, mark that option as well.

- Fill in the location of business property, including city, state, and phone number. Make sure to attach a copy of the federal Form 1065 and all necessary schedules according to the instructions provided.

- Complete Schedule SC-K first, as instructed. This schedule is essential for outlining each partner's share of income, deductions, and credits.

- Proceed to enter amounts from Schedule W-H. Calculate withholding tax on income of nonresident partners, ensuring to input the correct numbers from previous calculations.

- After completing all sections of the form, review your entries to confirm accuracy, and ensure that you have included all necessary attachments.

- Finalize your process by saving changes to the form. Download, print, or share the form according to your needs before submitting.

Complete your documents online today to ensure timely submission and compliance.

Related links form

If you file a joint federal return, you must file a joint SC1040 with Schedule NR. You will report all income for the entire year to South Carolina. Your spouse will only report income earned in this state. If you file separate federal returns, you must file a separate South Carolina return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.