Loading

Get Form 531

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 531 online

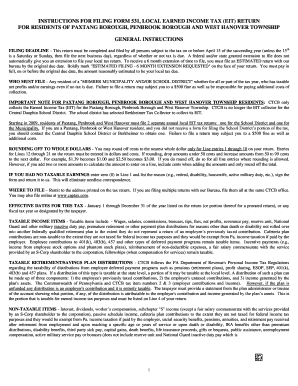

Filling out Form 531 online is a straightforward process designed to help residents of Paxtang Borough, Penbrook Borough, and West Hanover Township report their earned income tax. This guide provides clear instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete Form 531 online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Begin by entering your personal information, including your name, address, and Social Security number at the top of the form. Ensure that all information is accurate and up-to-date.

- Move to Line 1 and enter the total W-2 wages earned while residing in a 'MEMBER MUNICIPALITY AND/OR SCHOOL DISTRICT'. Attach a copy of all W-2 forms that reflect your earnings.

- For Line 2, report any allowable employee business expenses. Be sure to include supporting documentation if necessary to substantiate these deductions.

- Continue to Line 3, where you will subtract the total from Line 2 from Line 1 to arrive at your taxable W-2 earnings.

- On Line 4, include the total of other taxable earned income, such as tips or other compensation not reported on your W-2. Ensure to attach relevant documentation.

- Total your earnings from Lines 5 and 6 on Line 10 which reflects your total taxable earned income and net profits.

- Complete the rest of the form as directed, ensuring you follow all instructions for the remaining lines regarding taxable income and deductions.

- Once all sections are complete, review your entries for accuracy. Save your changes and download a copy of the completed form.

- Finally, you can print or share the form as needed, ensuring you file it according to the guidelines provided in the instructions.

Complete your Form 531 online today to ensure timely and accurate filing of your earned income tax.

To elect for S-Corp treatment, file Form 2553. You can make this election at the same time you file your taxes by filing Form 1120S, attaching Form 2533 and submitting along with your personal tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.