Loading

Get Schedule 500fed Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule 500fed Form online

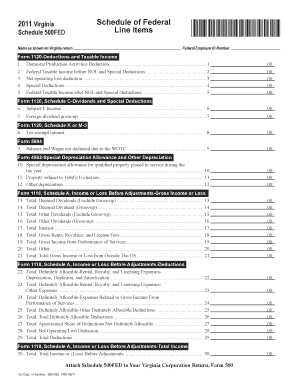

Filling out the Schedule 500fed Form online is a crucial step for accurately reporting federal taxes for your Virginia corporation. This guide aims to provide clear and detailed instructions to assist you in completing the form with confidence.

Follow the steps to fill out the Schedule 500fed Form online:

- Press the ‘Get Form’ button to access the Schedule 500fed Form and open it in your editing tool.

- Begin by entering your name as it appears on your Virginia return in the designated field.

- Input your Federal Employer ID Number (FEIN) in the specified section to identify your corporation.

- Proceed to fill out Line 1, reporting your Domestic Production Activities Deduction, if applicable.

- Continue with Line 2 and report your Federal Taxable Income before Net Operating Loss (NOL) and Special Deductions.

- On Line 3, enter the Net Operating Loss deduction amount, if any.

- Fill in Line 4 with any Special Deductions that apply to your situation.

- Line 5 should display your Federal Taxable Income after accounting for NOL and Special Deductions.

- For Lines 6 through 29, complete the relevant sections according to your income and deductions from various forms, ensuring accurate calculations.

- Once you have filled in all necessary fields, review the information for accuracy.

- Finally, save your changes, download a copy of the form, and select your preferred option to print or share it as needed.

Begin completing your Schedule 500fed Form online today for efficient document management.

If you do not agree to withhold additional tax, the employee may need to make estimated tax payments. An employee is exempt from Virginia withholding if he or she meets any of the conditions listed on Form VA-4 or VA-4P. The employee must file a new certificate each year to certify the exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.