Loading

Get Local Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Local Tax Form online

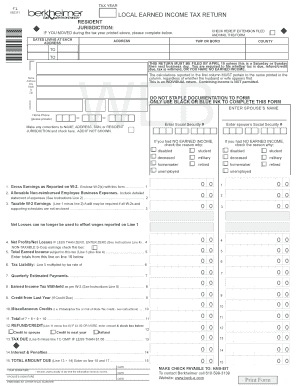

Filing your Local Tax Form online can be a straightforward process if you follow the right steps. This guide will walk you through each section of the form, ensuring that you provide the necessary information accurately and efficiently.

Follow the steps to complete your Local Tax Form online.

- Click ‘Get Form’ button to download the Local Tax Form and open it for editing.

- Begin by entering your personal information, including your name, address, and social security number. Ensure that this information is accurate and matches your identification documents.

- If applicable, enter your spouse's name and their social security number. Remember, this is an individual return; combining incomes is not permitted.

- If you had moves during the tax year, fill in the dates and addresses of each residence. This information is crucial for proper jurisdiction assignment.

- Complete the earnings section by reporting gross earnings as indicated on your W-2 forms. Enclose copies of these forms with your submission.

- Enter any allowable non-reimbursed employee business expenses in the specified section and include supporting documentation as necessary.

- Calculate your taxable income by subtracting line 2 from line 1 and ensure that you understand all calculations shown.

- Follow additional instructions related to miscellaneous credits and completed income proration if you moved during the year.

- Review the tax due and any payments already made, ensuring that all lines are accurately completed to avoid errors.

- Once all sections are filled out, you can save changes, download your completed form, print it for your records, or share it as needed.

Complete your Local Tax Form online today to ensure timely filing and compliance.

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.