Loading

Get State Of Ohio Form 941

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of Ohio Form 941 online

Completing the State Of Ohio Form 941 online can streamline your tax reporting process. This guide will walk you through each section of the form, ensuring that you fill it out accurately and efficiently.

Follow the steps to complete the State Of Ohio Form 941 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

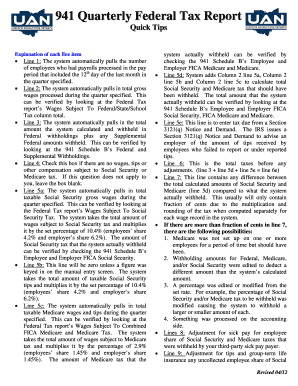

- Review the employee information section. Ensure that the number of employees who had payrolls processed during the relevant pay period is correctly displayed. This number should reflect those on payroll during the 12th day of the month in the specified quarter.

- Check Line 2 to confirm that the total gross wages processed during the quarter are accurately presented. This figure should be verified against the Federal Tax report.

- Examine Line 3 for the total Federal withholdings calculated. Make sure the amounts match those recorded in the 941 Schedule B.

- If applicable, check the box on Line 4 to indicate if there are no wages or compensation subject to Social Security or Medicare tax.

- Verify that Line 5a reflects the total taxable Social Security gross wages. This should match the Federal Tax report and be multiplied by the correct percentage.

- Line 5b should only have an entry if you have manual entries. Typically, this line will remain at zero unless updated.

- Ensure that Line 5c correctly shows the total taxable Medicare wages and tips, validated against the Federal Tax report.

- Line 5d will sum Lines 5a, 5b, and 5c. Make sure this matches the actual amounts withheld recorded in the 941 Schedule B.

- If there are any adjustments, Lines 8 and 9 must be filled in appropriately to reflect any sick pay or uncollected employee share of taxes.

- Line 10 calculates total taxes after adjustments. Ensure accuracy in totals.

- For Line 11, confirm the total deposits made for the quarter align with your submitted payments.

- Check Line 14 for the balance due by subtracting Line 13 from Line 10.

- If you have an overpayment, it will be shown in Line 15, which indicates total payments exceed total taxes.

- Verify Lines 16 and 17 for month-by-month tax liabilities based on your deposited amounts.

- Complete any optional sections regarding final returns or seasonal employment in Lines 17 and 18 as applicable.

- Finally, review your form for accuracy, then save your changes, download, print, or share the completed form as needed.

Start completing the State Of Ohio Form 941 online today for a seamless reporting experience.

Ohio IT 1140 or IT 4708? Qualifying PTEs whose equity investors are limited to nonresident individuals, nonresident estates, nonresident trusts and qualifying PTE investors can file either the Ohio IT 1140 or IT 4708.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.