Loading

Get Ftbcagov Form3525

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftbcagov Form3525 online

Filling out the Ftbcagov Form3525 online can seem daunting, but with the right guidance, you can complete it with confidence. This guide provides you with clear, step-by-step instructions to navigate the form effectively.

Follow the steps to complete the Ftbcagov Form3525 online

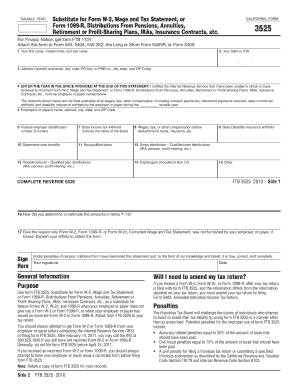

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with filling out your personal information. Enter your first name, middle initial, and last name in the designated fields.

- Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the appropriate field.

- Complete your address details including number and street, apartment or suite number, P.O. box or PMB, city, state, and ZIP Code.

- Enter the taxable year in the designated space. Make sure to accurately indicate the year for which you are filing.

- Fill in the name and address of your employer or payer, including the city, state, and ZIP Code.

- If known, include the federal employer identification number.

- Indicate the state income tax withheld, including the name of the state.

- Report your wages, tips, or other compensation before taxes and deductions.

- Provide information on dependent care benefits, nonqualified plans, and gross distributions from qualified plans, as applicable.

- Detail the taxable amounts from qualified plan distributions, including any capital gains.

- Describe how you determined or estimated the amounts for items 7 to 15 in the specified section.

- State the reason for not receiving Form W-2 or Form 1099-R, and explain your efforts to obtain it.

- Sign the form, ensuring that you’ve confirmed the accuracy of the information provided under penalties of perjury.

- Once all sections are filled out, you can save your changes, download, print, or share the form as necessary.

Start filling out the Ftbcagov Form3525 online today to ensure your tax documentation is complete and accurate.

E. When and Where to File Mail Form 565 with payment (LPs, LLPs, and REMICs only) to: Mail Franchise Tax Board. PO Box 942857. ... E-filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3587, Payment Voucher for LP, LLP and REMIC e-filed returns, with payment to: Mail Franchise Tax Board.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.