Loading

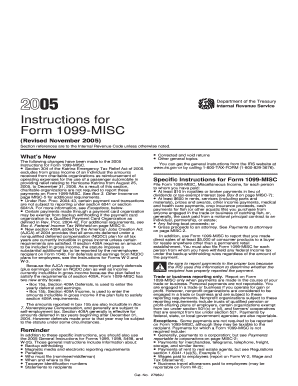

Get 2005 1099 Misc Fllable Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 1099 Misc Fllable Form online

Filling out the 2005 1099 Misc Fllable Form online is a straightforward process. This guide provides a step-by-step approach to ensure accurate completion of each section, making it accessible for users of all experience levels.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name, street address, city, state, ZIP code, and telephone number in the designated areas at the top of the form, ensuring accuracy for IRS records.

- Fill in your taxpayer identification number (TIN), which may be your social security number or employer identification number, in the indicated box.

- Provide the recipient's name, address, and TIN in the respective fields below your information, ensuring all details match IRS records.

- Complete the appropriate boxes for payments made throughout the year; for example, report rents in box 1, royalties in box 2, and nonemployee compensation in box 7.

- If federal income tax was withheld, enter the amount in box 4. Note that backup withholding applies when a TIN is not provided.

- Review all information for accuracy and completeness before proceeding to save your changes.

- Finally, download, print, or share the completed form as necessary while keeping a copy for your records.

Start completing your documents online today for a smoother filing experience.

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose income (AGI) is greater than $72,000. Taxpayers whose income is $72,000 or less qualify for IRS Free File partner offers, which can guide you through the preparation and filing of your tax return, and may include state tax filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.