Loading

Get It214 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It214 Form online

Filing your It214 Form online can be a straightforward process if you understand the necessary steps. This guide will help you navigate each section of the form, providing clear instructions to ensure you complete it accurately.

Follow the steps to fill out the It214 Form successfully

- Click ‘Get Form’ button to obtain the form and open it in the editor.

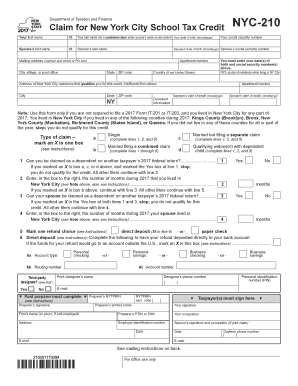

- Begin filling in your personal information. Enter your first name, middle initial, last name, date of birth, and social security number in the designated fields. If applicable, provide the same details for your spouse.

- Complete the mailing address section including your street address, city, state, ZIP code, and any necessary apartment number.

- Indicate your New York City residence address for the tax credit if it differs from your mailing address. Include the city, state, and ZIP code.

- Select your type of claim by marking an X in the appropriate box. Make sure to follow the instructions corresponding to your claim type.

- Answer the questions related to dependency status and provide the number of months you and your spouse lived in New York City during the specified year.

- Choose your refund option—either direct deposit or paper check—following the relevant instructions for each option.

- Fill in your bank account details if you selected direct deposit. Ensure to check the appropriate box based on whether the account is personal or business.

- Finalize the form by providing signatures for you and your spouse, if applicable. Include the date and any required identification numbers.

- After completing the form, save your changes, and consider downloading, printing, or sharing the finalized document as required.

Complete your It214 Form online today for a smoother tax refund process.

T4s are given to employees and the CRA. (You need to create a T4 for each province and territory in which the employee earned income.) T4As are given to contractors and the CRA. (Same as a T4, create one for each province and territory in which the contractor was paid.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.