Loading

Get 2007 8379 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 8379 Form online

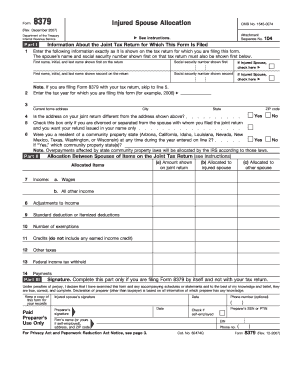

Filling out the 2007 8379 Form, designed for injured spouse allocation, can be straightforward when you know the steps. This guide will help you navigate each component of the form online, ensuring you accurately complete it to secure any joint refund you may be entitled to.

Follow the steps to successfully complete the 2007 8379 Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out Part I, which includes entering information about the joint tax return. While completing this section, make sure to accurately input the first spouse’s name and social security number as they appear on the tax return.

- Provide the second spouse’s name and social security number in the appropriate fields, checking the box if the spouse qualifies as the injured spouse.

- Input the tax year for which you are filing this form, followed by your current home address including city and ZIP code.

- Answer the question regarding whether the address on the joint return is different from the one you provided.

- Indicate if you lived in a community property state during the given tax year and specify which state(s) apply.

- Move to Part II where you will allocate items from the joint tax return. Fill in details such as wages, income, adjustments to income, deductions, exemptions, and credits by entering the relevant amounts allocated to each spouse.

- Carefully complete each line item listed, ensuring that all income and deductions are allocated correctly according to who would have claimed them on separate returns.

- In Part III, provide signatures from both spouses only if you are filing Form 8379 separately. Include the date and optional contact information if applicable.

- Once all sections are filled out, review the form for accuracy. You can then save your changes, download the completed document, print it, or share it as needed.

Complete your documents online today to ensure you receive the refund you deserve.

When should you file Form 8379? As soon as you know your refund will be affected by your spouse's qualifying debt, you can file Form 8379. You need to file the form for every tax year in which your refund was affected and for which you want to obtain injured spouse relief.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.