Loading

Get Form 8815

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8815 online

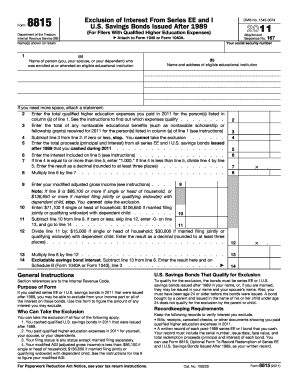

Filling out Form 8815 is essential for claiming the exclusion of interest from U.S. savings bonds issued after 1989, particularly for those with qualified higher education expenses. This guide will take you through each step of completing the form online, ensuring that you have all the necessary information at your disposal.

Follow the steps to complete Form 8815 effectively.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- In the top section, enter the name(s) shown on your return, which could be you, your spouse, or your dependent. Also, provide your social security number.

- In line 1, list the name of the person who was enrolled at or attended an eligible educational institution, along with the name and address of that institution.

- On line 2, input the total qualified higher education expenses that you paid for the person listed in line 1. Refer to the provided instructions for eligible expenses.

- Enter any nontaxable educational benefits received for that individual in line 3, ensuring these are correctly classified based on the guidelines.

- Subtract the amount on line 3 from line 2; if the result is zero or less, you cannot take the exclusion and should pause here.

- In line 5, record the total proceeds from all series EE and I U.S. savings bonds issued after 1989 that you cashed during the relevant year.

- Complete line 6 by entering the interest included from line 5, as per the instructions provided.

- Calculate the decimal value for line 7 based on the comparison of lines 4 and 5, ensuring to follow the specific rounding guidelines.

- Multiply the value from line 6 by the decimal from line 7 to get the result for line 8.

- Next, input your modified adjusted gross income on line 9, based on the calculations specified in the form.

- Follow through the remaining calculations for lines 10 through 14, ensuring all the provided instructions are closely adhered to.

- At the conclusion of your entries, ensure to save your changes, and consider downloading or printing the completed form for your records.

Complete your documents online today for a smoother filing experience.

Because Series EE savings bonds are low-risk and guaranteed to double in value in 20 years, they are among the best savings accounts for a grandchild. If Mom and Dad keep the savings bonds safely tucked away until college, the child can use savings bonds to help cover educational expenses or pay off student loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.