Loading

Get Schedule K 1 Form 8865 Year 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule K 1 Form 8865 Year 2011 online

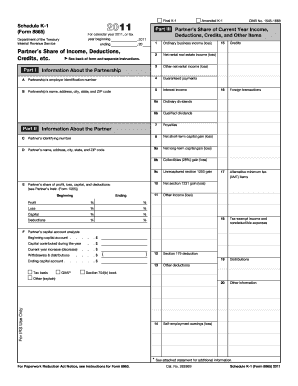

Filling out the Schedule K 1 Form 8865 for the year 2011 can be straightforward when you have a clear guide. This form is crucial for informing the Internal Revenue Service about each partner's share of income, deductions, and credits from a partnership. Follow the steps below to efficiently fill out the form online.

Follow the steps to complete the Schedule K 1 Form 8865 online.

- Click the ‘Get Form’ button to access the Schedule K 1 Form 8865 for the year 2011 and open it in your preferred editing tool.

- In Part I, fill in the information about the partnership. Start with the partnership’s name, address, and employer identification number, followed by ordinary business income (loss), net rental income (loss), and other specified income items.

- In Part II, identify yourself as the partner by providing your identifying number and personal information, including your name and address.

- Complete Part III by entering your share of the current year’s income, deductions, credits, and other items. Populate the fields, including guaranteed payments, dividends, royalties, and capital gains or losses as applicable.

- Ensure you have fully completed all applicable sections, checking for accuracy and completeness across all forms.

- Once you have reviewed your entries, you can save changes, download the filled form, print it out, or share it as needed.

Begin filling out your Schedule K 1 Form 8865 online today!

The failure to timely file a Form 8865 (or timely filing a Form 8865, but one which was incorrect or incomplete) is subject to a $10,000 penalty for each year of noncompliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.