Loading

Get Form W 4p 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-4P 2009 online

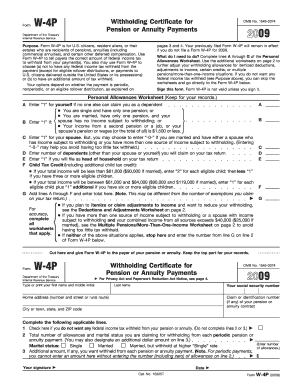

Form W-4P is essential for individuals receiving pension or annuity payments to ensure proper federal income tax withholding. This guide will walk you through the process of completing the form online, making it easy and efficient.

Follow the steps to fill out Form W-4P online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by carefully filling out your personal information. Enter your first name, middle initial, last name, social security number, and home address accurately.

- In line 1, check the box if you prefer not to have any federal income tax withheld from your pension or annuity.

- On line 2, indicate the total number of allowances you are claiming along with your marital status, either single or married.

- If you wish to have an additional amount withheld, specify the dollar amount on line 3.

- Sign the form in the signature section and include the date.

- Once you have completed all necessary fields, review the form for accuracy.

- After confirming that all information is correct, save your changes, download the form, and then print or share it as needed.

Complete your Form W-4P online today for hassle-free management of your tax withholding.

Related links form

Withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employee's paycheck. In practice, employees in the United States use Internal Revenue Service (IRS) Form W-4, Employee's Withholding Certificate to calculate and claim their withholding allowance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.