Loading

Get Non Filing Letter Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non Filing Letter Sample online

Filling out the Non Filing Letter Sample is a crucial step for individuals who need to clarify their tax filing status when applying for a fee waiver. This guide provides clear, step-by-step instructions to help you complete this form efficiently and accurately online.

Follow the steps to complete your Non Filing Letter Sample online

- Click the 'Get Form' button to obtain the form and open it in your preferred online document editor.

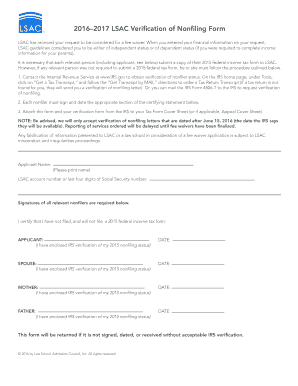

- In the section labeled 'Applicant Name,' clearly print your name as it appears on your identification documents.

- Provide your LSAC account number or the last four digits of your Social Security number in the designated field to help identify your application.

- Review the certifying statement that states you have not filed, and will not file, a 2012 federal income tax form. Ensure it is accurate before proceeding.

- For each relevant nonfiler, including yourself, your spouse, and your parents, there is a section where you need to sign and date. Confirm that you have enclosed IRS verification of your 2012 nonfiling status.

- Once you have filled in all required fields, attach the verification form from the IRS to your Tax Form Cover Sheet, or Appeal Cover Sheet if applicable.

- Before submission, double-check that each relevant nonfiler has signed and dated their section. The form will be returned if it is not signed, dated, or received without acceptable IRS verification.

- After ensuring all information is complete and accurate, proceed to save changes, download, print, or share the form as necessary.

Complete your Non Filing Letter Sample online today to ensure your fee waiver application is processed smoothly.

Available from the IRS by Calling 1-800-908-9946 2. Follow prompts to enter your Social Security Number and the numbers in the street address. 3. Select Option 2 to request an IRS Verification of Non-Filing Letter or Tax Return Transcript and then enter 2018 for the tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.