Loading

Get Wh 1605 Form 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wh 1605 Form 2012 online

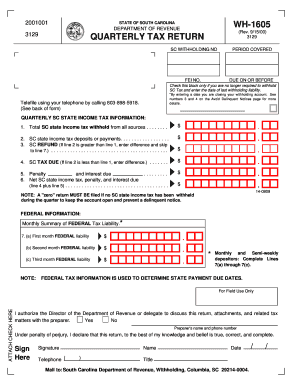

The Wh 1605 Form 2012 is a vital document for reporting state income tax withheld in South Carolina. This guide provides clear, step-by-step instructions on how to accurately complete this form online.

Follow the steps to fill out your Wh 1605 Form 2012 online.

- Click the ‘Get Form’ button to access the Wh 1605 Form 2012 and open it in the online editor.

- Enter your SC withholding number in the designated field. Ensure it is entered accurately to avoid any issues.

- Input the period covered for the tax return in the appropriate section. This should reflect the time frame for which you are reporting the withholding.

- Fill in the Federal Employer Identification Number (FEI NO.) if applicable. This information helps in identifying your business's tax obligations.

- Provide the due date of the return in the specified field. This ensures timely submission to avoid penalties.

- If you are no longer required to withhold SC Tax, check the appropriate block and enter the date of your last withholding liability.

- Report the total SC state income tax withheld from all sources in the corresponding field. Make sure you total this accurately.

- Indicate any SC state income tax deposits or payments made in the designated section.

- If applicable, enter the SC refund in the appropriate box if your deposits exceed your withheld amounts.

- Calculate the SC tax due by entering the difference if line 2 is less than line 1.

- Include any penalty or interest due in the specified fields. It's important to calculate these to avoid complications.

- Finally, add the net SC state income tax, penalty, and interest due. This will be your total liability.

- Complete the Federal tax liability section if you are a monthly or semi-weekly depositor.

- Sign the form in the designated area to certify the information provided under penalty of perjury.

- After completing all sections, you can save your changes, download the form, print it, or share it as needed.

Complete your Wh 1605 Form 2012 online today to ensure timely filing and compliance.

Withholdings. The exemption from income tax withholding does not change the amount of taxable income reported to the IRS or the NC Department of Revenue/state taxing authority, but it does ensure that no income tax is withheld from an employee's pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.