Loading

Get 2011 Form 945

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 945 online

Filling out the 2011 Form 945 online can simplify your federal tax reporting process. This guide provides step-by-step instructions to help you accurately complete the form and ensure compliance with IRS requirements.

Follow the steps to successfully fill out the 2011 Form 945 online.

- Press the ‘Get Form’ button to access the form and open it in the desired format.

- Enter your employer identification number (EIN) and the name of your business as shown on the Form 945, ensuring they match exactly with IRS records.

- Specify the calendar year for which you are filing this form.

- If you are filing as a semiweekly schedule depositor, be sure to check the appropriate box linked to this status.

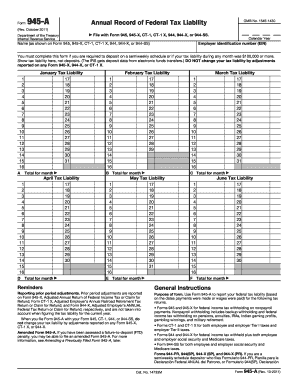

- Enter your federal tax liabilities for each month, ensuring to report the amounts corresponding to the date wages or nonpayroll payments were made, as outlined in the form instructions.

- Calculate the total for each month and enter this into the respective total lines (A through L), remembering that line M should reflect the total tax liability for the year.

- Review all entries for accuracy, ensuring that the total at the end matches with your Form 945, 944, or CT-1 as appropriate.

- Once all information is complete, you can save your changes, download the form for your records, print it, or share it as needed.

Complete your 2011 Form 945 online today to ensure accurate federal tax reporting.

Sections 3402, 3405, and 3406 of the Internal Revenue Code require taxpayers to pay over to the IRS federal income tax withheld from certain nonpayroll payments and distributions, including backup withholding. Form 945 is used to report these withholdings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.