Loading

Get St556 Form No No Download Needed Needed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St556 Form No No Download Needed Needed online

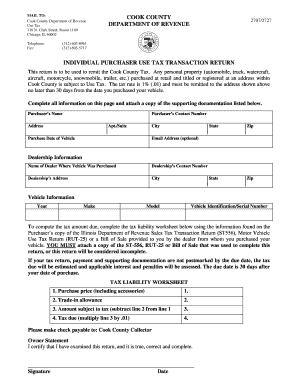

Completing the St556 Form No No Download Needed Needed is an essential step for remitting the Cook County Use Tax on personal property purchases. This guide will provide you with clear instructions to help you navigate each section of the form efficiently and effectively.

Follow the steps to submit your St556 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Purchaser's Name' field, enter your full name as the buyer of the vehicle. Then, fill in your contact number to ensure you can be reached if further information is required.

- Provide your full address, including any apartment or suite numbers. Be sure to complete the city, state, and zip code fields accurately.

- Input the purchase date of your vehicle in the designated field. Optionally, you can add your email address for any correspondence regarding your submission.

- Next, fill out the dealership information. Enter the name of the dealership where the vehicle was purchased along with their contact number.

- Complete the dealership's address fields, including city, state, and zip code.

- Provide detailed information about the vehicle, including the year, make, model, and vehicle identification or serial number.

- Proceed to the Tax Liability Worksheet. Using the information from your purchase documents, fill in the purchase price of the vehicle, including any accessories.

- If applicable, enter any trade-in allowance you received for your previous vehicle.

- Calculate the amount subject to tax by subtracting the trade-in allowance from the purchase price. That value should be entered on the appropriate line.

- Multiply the amount subject to tax by the tax rate of 1% to determine the tax due, and list this amount in the final section of the worksheet.

- If required, attach a copy of the supporting documentation, such as the ST-556 or RUT-25 forms, or the bill of sale from your vehicle purchase.

- Sign and date the form to certify that the information you provided is accurate and complete.

- Finally, follow the instructions to submit your completed form online. You may have options to save changes, download, print, or share the form as needed.

Complete your St556 form online today to ensure your compliance with Cook County tax regulations.

Form ST-556 can be filed electronically by using MyTax Illinois at mytax.illinois.gov or by using an approved service provider in the Electronic Registration and Title program (ERT).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.