Loading

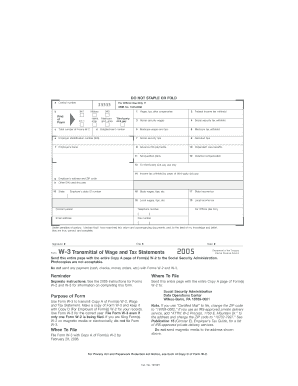

Get 2005 Form W-3 - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Form W-3 - Irs online

Filling out the 2005 Form W-3 is an essential task for employers to transmit wage and tax statements to the Social Security Administration. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the 2005 Form W-3 online.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- In the control number field, enter the relevant control number, if applicable. This is typically used for internal tracking purposes.

- Indicate the type of payer by selecting the appropriate box, such as '941' for most employers.

- In the total number of Forms W-2 field, enter the total forms you are transmitting with this W-3.

- Provide your Employer Identification Number (EIN) in the designated field.

- Fill in your employer's name and address, making sure to include the correct ZIP code.

- If applicable, list any other EIN you have used during the tax year.

- Complete the boxes for wages, tips, and other compensation, ensuring accuracy in the amounts reported.

- Continue filling out the tax withheld and wage information, as prompted by the form, including federal income tax, Medicare wages, and social security wages.

- Once all relevant sections are completed, review the form for accuracy, ensuring no fields are left blank.

- After confirming all information is correct, you can save changes, download, and print the form or prepare it for electronic submission.

Complete your documents online today for a streamlined filing experience.

You might wonder, Can a W-2 be handwritten? No, it cannot.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.