Loading

Get Ct W4p 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct W4p 2012 Form online

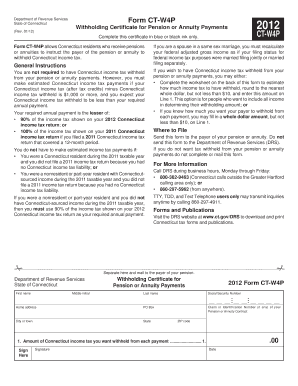

The Ct W4p 2012 Form is a withholding certificate for pension or annuity payments that allows Connecticut residents to instruct the payer on how much state income tax to withhold. This guide provides clear instructions to help users fill out the form accurately online.

Follow the steps to complete the Ct W4p 2012 Form online.

- Press the ‘Get Form’ button to access the Ct W4p 2012 Form and open it in your preferred digital format.

- Begin by entering your personal information, including your first name, middle initial, last name, Social Security number, home address, city or town, state, and ZIP code. Ensure that all details are accurate for processing.

- If applicable, provide the claim or identification number for your pension or annuity contract. This information may help your payer identify your account more easily.

- On Line 1, specify the amount of Connecticut income tax you wish to have withheld from each payment. It is recommended to round this amount to the nearest whole dollar, ensuring it's not less than $10.

- If you decide to calculate your withholding based on estimated income, complete the worksheet on the back of the form. Fill in the necessary lines regarding your expected federal adjusted gross income, allowable Connecticut modifications, and other relevant calculations as instructed.

- After completing the worksheet, use the results to fill in the amount you wish to be withheld from each payment on Line 1.

- Sign and date the completed form at the bottom to verify that all provided information is accurate.

- Once you have filled out and signed the form, save your changes. You may also download, print, or share the completed Ct W4p 2012 Form as needed.

Complete your documents online today to ensure accurate processing and timely submissions.

Connecticut State Income Tax Withholding Information Filing StatusDescriptionBHead of HouseholdCMarried - Filing Jointly, Spouse Not WorkingDMarried - Filing Jointly, Both Spouses Working (combined income greater than $100,500)FSingle1 more row

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.