Loading

Get Cf 1040 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cf 1040 Form online

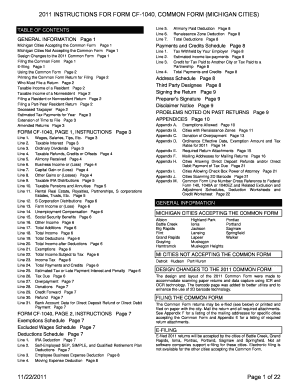

Filling out the Cf 1040 Form online is a streamlined process that ensures accuracy and efficiency. This guide provides clear, step-by-step instructions to assist users in successfully completing the form.

Follow the steps to complete your Cf 1040 Form online.

- Press the ‘Get Form’ button to download the Cf 1040 Form and open it in your preferred online editing tool.

- Begin by entering your personal information at the top of the form, including your name, address, and social security number. If applicable, include your spouse's information.

- Fill out the section regarding your residency status and filing status. Ensure that you select the correct option based on your living situation.

- Calculate your taxable income by entering relevant figures such as wages, salaries, and other sources of income in the designated lines.

- Complete the deductions portion by itemizing any applicable deductions. Refer to the guidelines for what qualifies as a deductible expense.

- Review the exemptions schedule and enter the appropriate number of exemptions you are claiming.

- Calculate the total income subject to tax and the corresponding tax amount based on your city’s tax rate.

- If any payments have been made or credits are available, enter those in the respective sections to calculate any overpayment or tax due.

- Sign and date the form at the end. If you are filing jointly, ensure that both spouses have signed.

- Once all information is accurately reviewed and completed, you can save the changes, download the form, print it, or share it as needed.

Start filling out your Cf 1040 Form online today to ensure a smooth and compliant tax season.

If your AGI is less than your personal exemption allowance and City income tax was withheld from your earnings, you must file a return to claim a refund of the tax withheld. Nonresident/Part-Year: File a return if you owe tax, are due a refund, or your wages exceed your exemption allowance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.