Loading

Get 941 Schedule R

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 941 Schedule R online

Filling out the 941 Schedule R online can seem challenging, but with clear guidance, the process can be straightforward. This comprehensive guide will walk you through each section and field of the form, ensuring you have all the necessary information to complete it accurately.

Follow the steps to fill out your 941 Schedule R

- Press the ‘Get Form’ button to obtain the form and open it in your web browser’s editor.

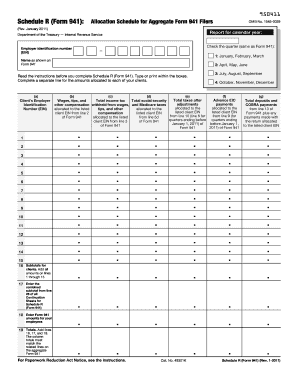

- Enter your employer identification number (EIN) at the top of the Schedule R to ensure it matches the one provided on Form 941.

- Input the name of your business as it appears on Form 941, ensuring accuracy to prevent processing issues.

- Designate the calendar year related to the quarter you are filing by entering it in the specified field.

- Select the appropriate box corresponding to the quarter you are reporting (January-March, April-June, etc.). Ensure it aligns with the quarter indicated on Form 941.

- For each client, list their employer identification number (EIN). This information is essential for individual allocation.

- Detail the wages, tips, and other compensations allocated to the listed client EIN as specified in line 2 of Form 941.

- Continue filling out the necessary information for each client, ensuring that you complete a separate line for each client on the form.

- If you need more than 15 clients, attach as many continuation sheets for Schedule R as necessary.

- Once you have filled in all necessary fields and are satisfied with the accuracy of the entries, proceed to save your changes, download the form, or print for your records.

Complete your 941 Schedule R online today to ensure accurate reporting and compliance.

You're required to file a separate Form 941 for each quarter (first quarter - January through March, second quarter - April through June, third quarter - July through September, fourth quarter - October through December). Form 941 is generally due by the last day of the month following the end of the quarter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.