Loading

Get Idaho Form 41es

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idaho Form 41es online

This guide provides a comprehensive overview of how to fill out the Idaho Form 41es online, ensuring that you understand each section and field of this important document. By following the outlined steps, you will be well-equipped to navigate the form with confidence.

Follow the steps to successfully complete your Idaho Form 41es online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

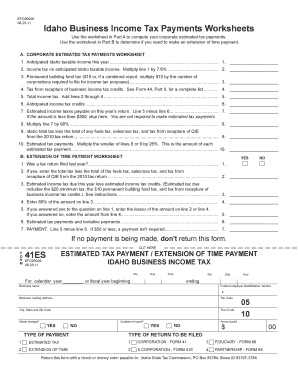

- Begin with the corporate estimated tax payments worksheet. Start by entering your anticipated Idaho taxable income for the current year in the designated field.

- Calculate the income tax on your anticipated Idaho taxable income by multiplying the amount from step 2 by 7.6%. Enter this figure in the corresponding space.

- Input the permanent building fund tax. If applicable, enter $10 or multiply $10 by the number of corporations required to file for income tax purposes in your report.

- Record any tax from recapture of business income tax credits as directed. Refer to Form 44, Part II, for details on applicable tax credits to include.

- Add the amounts from lines 2 through 4 to calculate your total income tax. Write this total in the appropriate field.

- Enter any anticipated income tax credits that may apply to your situation in the space provided.

- Determine your estimated income taxes payable for the current year's return by subtracting the amount from step 7 from the total income tax calculated earlier.

- If the result from step 8 is less than $500, you are not required to make estimated tax payments, and you can stop here.

- Multiply the amount from step 8 by 90% and enter the result in the designated field.

- Calculate your Idaho total tax based on the previous year's return, excluding any fuels tax, sales/use tax, and other specified tax categories.

- Determine your estimated tax payments by multiplying the lesser of the two amounts from steps 10 and 11 by 25%. This is your estimated payment amount.

- For the extension of time payment worksheet, answer whether you filed a tax return last year and proceed to fill in the necessary fields based on the instructions provided.

- After completing all necessary fields, carefully review your entries for accuracy.

- Once satisfied, you can choose to save changes, download a copy, print the form, or share it as needed.

Complete your Idaho Form 41es online today for seamless tax management.

As of 2020, these states included Alabama, Arkansas, California, Delaware, Georgia, Illinois, Louisiana, Mississippi, New York, North Carolina, Oklahoma, Tennessee, and Texas. Kansas, Missouri, Pennsylvania, and West Virginia all discontinued their corporate franchise taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.