Loading

Get Fincen Form 114 Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

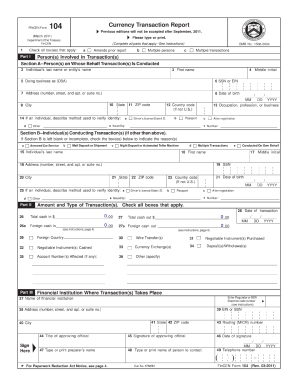

How to fill out the Fincen Form 114 Sample online

Filling out the Fincen Form 114 Sample online is a crucial process for reporting foreign bank accounts. This guide provides step-by-step instructions on how to complete the form accurately and efficiently.

Follow the steps to successfully fill out the Fincen Form 114 Sample online.

- Click the ‘Get Form’ button to obtain the Fincen Form 114 Sample and open it in the designated editor.

- Begin filling out your personal identification information in the required fields. This includes your name, address, and taxpayer identification number.

- Provide details regarding your financial accounts held outside the United States. Include account numbers, the names of the financial institutions, and the maximum value of each account during the reporting period.

- Indicate the type of accounts you are reporting, such as savings, checking, or investment accounts.

- Review your entries to ensure accuracy and completeness, making any necessary corrections or adjustments.

- Save your changes within the editor. You can then choose to download, print, or share the completed form as needed.

Start filling out your forms online today with ease and confidence.

Deadline for reporting foreign accounts This means that the 2018 FBAR, Form 114, must be filed electronically with the Financial Crimes Enforcement Network (FinCEN) by April 15, 2019. FinCEN grants filers missing the April 15 deadline an automatic extension until Oct. 15, 2019, to file the FBAR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.