Loading

Get Supporting Documents For Dependency Exemptions Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Supporting Documents For Dependency Exemptions Form online

The Supporting Documents For Dependency Exemptions Form is essential for users to demonstrate eligibility for claiming dependency exemptions on tax returns. This guide will provide clear, step-by-step instructions for successfully completing the form online.

Follow the steps to fill out the form correctly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

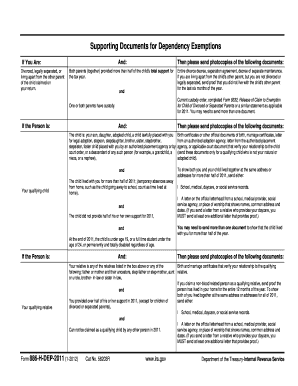

- Review the form's requirements regarding your relationship to the dependent. Ensure that you understand which documents are necessary based on your relationship to the child or qualifying relative.

- If applicable, provide photocopies of documents such as current custody orders or Form 8332 to release the claim of exemption. This is necessary if you are divorced, legally separated, or living apart from the other parent.

- Prepare and upload necessary documents verifying your relationship to the child, like birth certificates, marriage certificates, or letters from adoption agencies, if required.

- If claiming a child, ensure to document proof of their residence with you for more than half of the year with school, medical, or social service records.

- Gather and submit any additional paperwork that shows you provided more than half of the dependent's total support for the year, such as statements from child support agencies or utility bills.

- Once all information and documents are completed, save any changes made to the form. You can also choose to download, print, or share the form as needed.

Begin completing your Supporting Documents For Dependency Exemptions Form online today.

School records or statement. Landlord or property management statement. Health provider statement. Medical records. Child care provided records. Placement agency statement. Social service records or statement. Place of worship statement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.