Loading

Get Form 886 H Eic

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 886 H Eic online

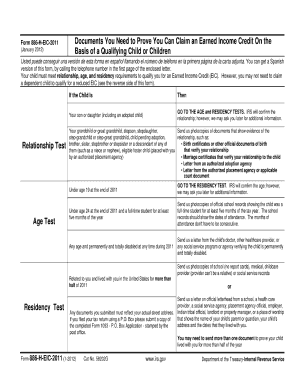

Filling out Form 886 H Eic can seem daunting, but this guide will simplify the process for you. This form is essential for individuals seeking to claim the Earned Income Tax Credit, and understanding how to accurately complete it online is crucial.

Follow the steps to successfully complete Form 886 H Eic online.

- Click ‘Get Form’ button to download the form and open it for editing.

- Begin by filling out your personal information at the top of the form, including your name, address, and Social Security number. Ensure these details are accurate as they are crucial for processing your application.

- Next, provide the information regarding your qualifying child, if applicable. This includes their name, age, relation to you, and whether they lived with you for more than half of the year.

- In this step, indicate your earned income for the year, ensuring it aligns with the income documentation you have. This is vital for determining your eligibility for the Earned Income Tax Credit.

- Review all the fields you've completed. Double-check for any errors or missing information that may delay processing.

- Once satisfied with your entries, you can save your changes, download the form for your records, print it, or share it as necessary.

Start filling out your Form 886 H Eic online today to ensure you meet your tax responsibilities efficiently.

School records or statement. Landlord or property management statement. Health provider statement. Medical records. Child care provided records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.