Loading

Get 941 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

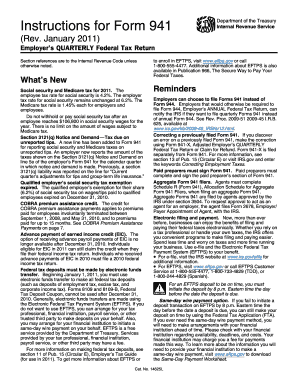

How to use or fill out the 941 Fillable online

Filling out the 941 Fillable form is an essential task for employers to report payroll taxes accurately. This guide provides a step-by-step approach to completing the form online, ensuring clarity and ease of understanding for all users, regardless of their experience with tax forms.

Follow the steps to complete your 941 Fillable form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your employer identification number (EIN), legal business name, and address in the designated fields. Ensure that the information matches IRS records to avoid delays.

- Select the appropriate quarter for which you are filing by checking the corresponding box at the top of the form.

- Input the total wages, tips, and compensation in line 2 of the form, which will also align with box 1 of your employees’ W-2 forms.

- On lines 3 and 5a-5d, report the federal income tax withheld and the social security and Medicare wages and tips.

- To record any adjustments related to taxes, complete lines 7 to 9 as necessary, ensuring accuracy for proper tax liability.

- Add all calculated amounts to determine your total tax liability on line 10, ensuring it accurately reflects your tax obligations for the quarter.

- If there are any overpayments, complete line 15 to choose whether the overpayment should be refunded or applied to your next return.

- Sign the completed form on page 2, confirming the information provided is accurate and complete, then proceed to file it according to IRS guidelines.

- After filing, ensure you save changes, download your completed form, print it for your records, or share it as required.

Complete your forms online today to ensure timely and accurate filings!

See Form 4506-T, Request for Transcript of Tax Return, or you can quickly request transcripts by using our automated self-help service tools. Please visit us at IRS.gov and click on Get a Tax Transcript... or call 1-800-908-9946.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.