Loading

Get Individual Payment Voucher Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Individual Payment Voucher Form online

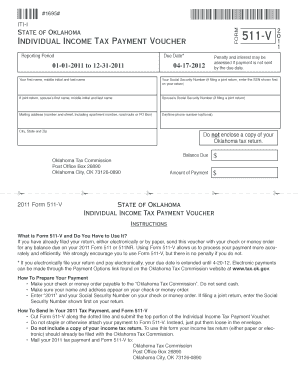

Filling out the Individual Payment Voucher Form online is a straightforward process that helps ensure your tax payment is processed efficiently. This guide will walk you through each section of the form to assist you in completing it accurately.

Follow the steps to complete the Individual Payment Voucher Form

- Click the ‘Get Form’ button to obtain the Individual Payment Voucher Form and access it in the editor.

- Enter your full name, including your first name, middle initial, and last name, in the designated field. This information is essential for identifying your payment.

- Input your Social Security Number in the corresponding field. If you are filing a joint return, make sure to enter the Social Security Number shown first on your return.

- If applicable, fill in your spouse’s first name, middle initial, and last name. Include their Social Security Number in the designated field if filing jointly.

- Provide your complete mailing address, including the street number, apartment number (if applicable), rural route or PO Box, as well as your city, state, and zip code.

- Optionally, enter your daytime phone number for any follow-up, but it is not mandatory.

- Enter the balance due from your tax return in the designated field to indicate the amount you owe.

- Specify the amount of payment you are submitting with the voucher in the appropriate field.

- After completing the form, review your entries for accuracy, ensuring all mandatory fields are filled out correctly.

- Save your changes, then download or print the completed form for your records. You may also share the completed form as needed.

Complete your Individual Payment Voucher Form online today to ensure timely processing of your tax payment.

Arizona Individual Income Tax payment Voucher for Electronic Filing (This form has no separate instructions) Form is used by a individual who electronically files an income tax return (Form 140) and is separately mailing payment for taxes not remitted with the tax form, when filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.