Loading

Get F944 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F944 2011 Form online

Filling out the F944 2011 Form online is a straightforward process that enables employers to report their annual federal taxes efficiently. This guide provides step-by-step instructions to ensure you complete the form accurately and confidently.

Follow the steps to successfully complete your F944 2011 Form online

- Press the ‘Get Form’ button to access the F944 2011 Form and open it in your chosen online editor.

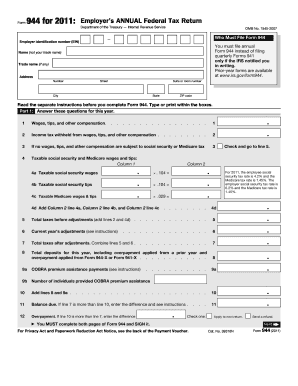

- Begin by entering your employer identification number (EIN) in the designated field to establish your identity as a taxpayer.

- Fill in your name and trade name, if applicable, ensuring that the name provided is not the trade name.

- Provide your address details including number, street, suite or room number, city, state, and ZIP code.

- In Part 1, answer the questions accurately for the current year regarding wages, tips, other compensations, and income tax withheld.

- If you have no wages subject to social security or Medicare tax, check the appropriate box and skip to line 5.

- Calculate your taxable social security and Medicare wages as directed, utilizing the specified rates for employees and employers.

- Add up the relevant lines to determine total taxes before adjustments and complete the necessary fields for line 6 and line 7.

- Enter your total deposits for the year after considering previous overpayments, if applicable.

- Complete Part 2 by indicating your deposit schedule and tax liability, ensuring totals agree with earlier calculations.

- If your business has closed, check the relevant box in Part 3 and provide the final date wages were paid.

- Decide if you wish to designate a third party for IRS communication and fill in the necessary details.

- Sign the form, making sure to print your name, title, and date, as well as providing a valid daytime phone number.

- Once all fields are completed, save your changes, and you have the option to download, print, or share the form as needed.

Complete your F944 2011 Form online today for a seamless filing experience.

As an employer, if you have not paid your employees any wages for the quarter, your tax amount will automatically be zero. Even if your tax amount is zero, the IRS expects you to file your Form 941. There is no need to waste your time entering zeros throughout your Form 941.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.