Loading

Get 760py Inc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 760PY Inc online

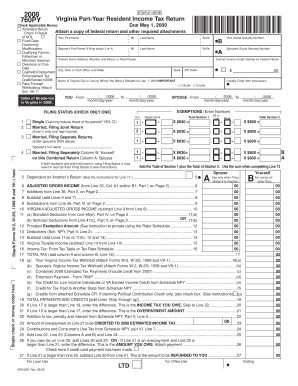

Filling out the 760PY Inc form is an essential task for Virginia part-year residents. This guide provides users with clear instructions on completing each section of the form effectively.

Follow the steps to complete the form easily and accurately.

- Click ‘Get Form’ button to access the 760PY Inc form and open it in your editor.

- Start by checking the applicable boxes for your filing status, including options for an amended return, and indicate if you’re overseas or eligible for certain tax credits.

- Fill in your personal details, including your first name, middle initial, last name, and suffix, along with your spouse's information if applicable.

- Provide your present home address, including street address, city, state, and ZIP code. Ensure this information is accurate for tax-related correspondence.

- Specify the dates of your residence in Virginia for the year 2008. Use the format month/day/year for clarity.

- Complete the exemption section by indicating the number of exemptions you and your spouse are claiming.

- Calculate your adjusted gross income according to the provided lines. Include any additions or subtractions to your income as specified.

- Determine your deductions, choosing between the standard deduction and itemized deductions based on your previous tax return.

- Calculate your total tax by referring to the relevant tax tables or rate schedules, and ensure all calculations are accurate.

- Verify and finalize all entries before submitting your form. You can save changes, download, print, or share the completed form as needed.

Complete your 760PY Inc form online today to ensure timely and accurate filing.

Nonresidents of Virginia must file a Form 763. (A person is considered a nonresident of Virginia if they lived in Virginia for less than 183 days in a calendar year). An instruction booklet with return mailing address is also available on the website. Part-Year Residents of Virginia file a Form 760PY.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.