Loading

Get 2010 Form 1040 V

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 1040 V online

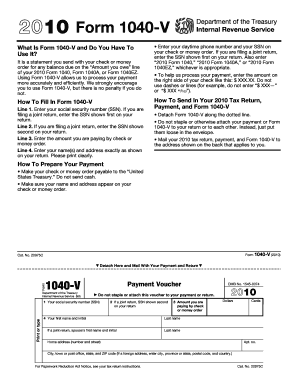

Filling out the 2010 Form 1040 V is a crucial step for individuals who owe taxes. This guide provides clear instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to fill out the 2010 Form 1040 V online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your social security number (SSN) in Line 1. If filing a joint return, input the first SSN listed on your return.

- If you are filing a joint return, enter the second SSN in Line 2.

- In Line 3, specify the amount you are paying by check or money order.

- For Line 4, provide your name(s) and address exactly as it appears on your return. Ensure to print clearly.

- Include your daytime phone number and your SSN on your check or money order, using the first SSN if filing jointly.

- In conjunction with your payment, enter '2010 Form 1040', '2010 Form 1040A', or '2010 Form 1040EZ' as applicable.

- Process your payment by making your check or money order payable to the 'United States Treasury'. Avoid sending cash.

- Detach Form 1040 V along the dotted line. Do not staple or attach it to your return or payment; place them loosely in the envelope.

- Mail your filled out 2010 tax return, payment, and Form 1040 V to the appropriate address listed on the back of the form.

- Finally, save changes, download, print, or share the form as required.

Complete your tax documents online today for a seamless filing experience.

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.