Loading

Get Form E 6

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form E 6 online

Filling out the Form E 6 online can seem daunting, but with the right guidance, you can navigate through it easily. This comprehensive guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the Form E 6 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

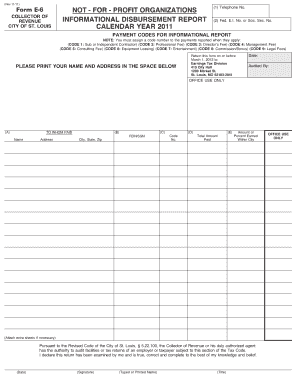

- Fill in boxes 1 and 2 with your telephone number and either your Federal Employer Identification Number or Social Security Number.

- In Column A (To Whom Paid), provide the complete name, address, city, state, and zip code of the individual, partnership, or corporation you paid.

- In Column B (FEIN/SSN), enter the Federal Employer Identification Number or Social Security Number, if available, of the person or entity who was paid.

- In Column C (Code No.), choose the applicable code that best describes the type of payment made from the provided list.

- In Column D (Total Amount Paid), indicate the total amount paid to the individual or entity.

- In Column E (Amount or Percent Earned Within City), record the amount or percentage of Column D that applies to work performed within the City of St. Louis.

- If you issued Form 1099-MISC, you may attach legible copies of the forms, noting the applicable city amounts and code numbers on each 1099.

- Date, sign, and print your name in the designated space at the end of the form.

- To submit the form, return it by the deadline of March 1, 2012, to the specified address.

Complete your Form E 6 online and ensure timely submission to avoid any penalties.

Residents of the City of St. Louis, regardless of the location of their employer. Employees of businesses located or performing work/services within the City of St. Louis, regardless of where they live.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.