Loading

Get Fill In St 100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill In St 100 online

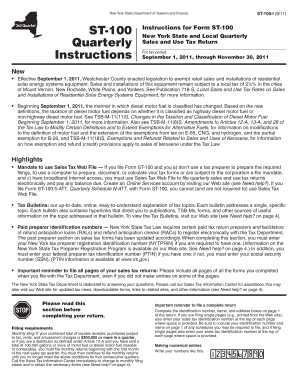

Completing the Fill In St 100 online can seem daunting, but this guide provides clear, step-by-step instructions to help you navigate the process effectively. Follow along to ensure your quarterly sales and use tax return is accurate and submitted on time.

Follow the steps to confidently fill out the Fill In St 100 online.

- Click the ‘Get Form’ button to access the Fill In St 100. This action will open the document in your preferred online format, ready for completion.

- Begin by entering your gross sales and services in box 1. This total should encompass all taxable, nontaxable, and exempt sales, excluding sales tax.

- Identify and complete any required schedules that must accompany the Form ST-100 based on your previous responses.

- Calculate your sales and use taxes. Use the totals from the completed schedules to fill in boxes 3, 4, and 5 on page 2 of the form.

- Subtotal your Column C (taxable sales), Column D (purchases subject to tax), and Column F (sales and use tax) calculations on page 2. Transfer these amounts to page 3.

- Add up the amounts from box 14 and box 15, then subtract box 16 to find the taxes due, entering your result in box 17.

- If applicable, calculate your vendor collection credit in Step 7 and complete the required fields on box 18.

- Calculate your total amount due. Adjust for any credits claimed previously and ensure all numbers are accurate.

- Mark the third-party designee area if you wish to authorize someone to discuss your return with the New York State Tax Department, providing the required details.

- Finally, sign and date the form, ensuring all authorized signatures are present. Keep a copy for your records.

Start completing your Fill In St 100 online today to ensure compliance and timely submission.

New York sales tax details The New York (NY) state sales tax rate is currently 4%. Depending on local municipalities, the total tax rate can be as high as 8.875%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.