Loading

Get Form Ct K 1t

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT K-1T online

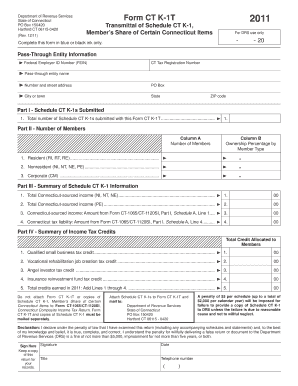

Filling out the Form CT K-1T is an important step for pass-through entities in Connecticut to report members' shares of income. This guide will help you understand each section of the form and provide clear instructions on how to complete it online.

Follow the steps to complete the Form CT K-1T online.

- Press the ‘Get Form’ button to access the form and open it in your browser or document editor.

- Fill in the pass-through entity information at the top of the form. This includes the Federal Employer Identification Number (FEIN), Connecticut Tax Registration Number, entity name, and address details.

- In Part I, enter the total number of Schedule CT K-1s that you are submitting with this Form CT K-1T.

- Move to Part II and list the number of members in Column A, differentiating between resident, nonresident, and corporate members. In Column B, enter the ownership percentage for each member type. Ensure that the total ownership percentage equals 1.0000.

- Proceed to Part III and summarize the Schedule CT K-1 information. Enter the total Connecticut-sourced income for nonresidents, pass-through members, and the tax liability amounts as specified.

- In Part IV, complete the summary of income tax credits. Enter the allocated totals for each credit type from all submitted Schedule CT K-1s.

- Review your entries for accuracy. Once all sections are complete, save your changes. You can then download, print, or share the completed form as necessary.

Begin filling out Form CT K-1T online to ensure your compliance and reporting are up-to-date.

Thanks to a bipartisan budget passed back in 2017, a Republican proposal to reduce taxes on retirement income and Social Security is now in place in CT and will impact 2019 tax returns. Retirees making $75K or less and couples making $100k or less per year are now fully exempt from state income tax on Social Security.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.