Loading

Get 2011 Form Mo 1040a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form Mo 1040a online

This guide provides a comprehensive overview of how to complete the 2011 Form Mo 1040a online. It offers step-by-step instructions tailored for users of all experience levels, ensuring that everyone can efficiently and accurately fill out their tax return.

Follow the steps to complete your Form Mo 1040a online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

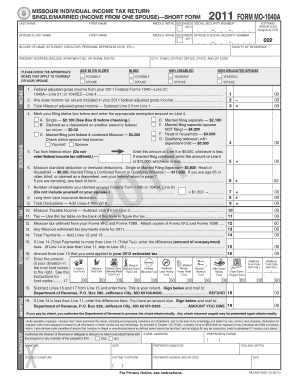

- Enter your last name, first name, middle initial, and social security number in the designated fields. Include the information for your spouse if applicable.

- Fill in your present address, including apartment number or rural route, and check the appropriate boxes that pertain to your eligibility (age, disability status, etc.).

- Report your federal adjusted gross income from your 2011 Federal Forms 1040, 1040A, or 1040EZ on Line 1. Enter any state income tax refund on Line 2, and calculate your total Missouri adjusted gross income on Line 3 by subtracting Line 2 from Line 1.

- Determine your filing status and enter the appropriate exemption amount on Line 4 based on your circumstances. Check the corresponding box to confirm your filing status.

- Enter the tax amount from your federal return on Line 5.

- In Line 6, report either your Missouri standard deduction or your itemized deductions, referencing the appropriate values based on your filing status.

- List the number of dependents claimed on your Federal Form and multiply by the specified amount on Line 7.

- Complete the lines for long-term care insurance deduction (Line 8) and sum up your total deductions on Line 9.

- Calculate your Missouri taxable income by subtracting Line 9 from Line 3 and enter it on Line 10.

- Use the provided tax table or worksheet to determine the tax owed based on your taxable income, and enter it on Line 11.

- Include the amounts withheld from your Forms W-2 and any estimated tax payments on Lines 12 and 13 respectively, and calculate total payments on Line 14.

- Check if you have an overpayment (Line 15) or an amount due (Line 19). Complete the applicable line based on your calculation.

- If applicable, authorize any donations or deductions as indicated on Lines 16 and 17.

- Finally, review all entries for accuracy. You can save changes, download, print, or share the filled-out form as needed.

Complete your documents online for a smoother experience during tax season.

Who needs to file Form 1040? Most people in the U.S. need to file Form 1040, whether they are independent contractors, freelancers, work for someone else as an employee, or live off income from investments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.