Loading

Get Illinois 2010 Schedule Icr Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois 2010 Schedule ICR Form online

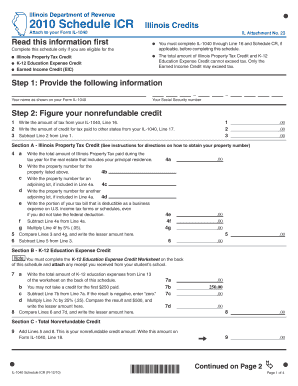

Filling out the Illinois 2010 Schedule ICR Form can seem daunting, but with this comprehensive guide, you will be able to navigate it with confidence. This online form is essential for calculating property tax, K-12 education expenses, and earned income credits applicable to your Illinois income tax return.

Follow the steps to complete the Illinois 2010 Schedule ICR Form accurately.

- Click ‘Get Form’ button to access the Illinois 2010 Schedule ICR Form and open it in your editor.

- Provide your name as it appears on your Form IL-1040 along with your Social Security number. This information is necessary for identification.

- Figure your nonrefundable credit. Start by writing the amount of tax from your IL-1040, Line 16, and the amount of credit from your IL-1040, Line 17. Subtract the latter from the former.

- In Section A for Illinois Property Tax Credit, write the total amount of property tax paid during the tax year for your principal residence on Line 4a. Additionally, provide the property number for the property and any adjoining lots on Lines 4b, 4c, and 4d.

- Determine the deductible portion of your tax bill as a business expense on Line 4e. Then, subtract it from Line 4a and multiply by 5% (Line 4f). Compare this result with the previous calculation and write the lesser amount on Line 4g.

- In Section B for K-12 Education Expense Credit, submit the total amount of K-12 education expenses on Line 7a, following the provided worksheet. Remember, you cannot take a credit for the first $250 paid.

- Once you’ve calculated the expenses and any related credits, you will have a total nonrefundable credit amount on Line 9. Write this amount on Form IL-1040, Line 18.

- For the refundable Earned Income Credit, list your federal EIC amount and perform the necessary calculations according to the instructions on Lines 10a to 11.

- Finally, review all the fields for accuracy. You can save your changes, download, print, or share the completed form as needed.

Start completing your Illinois 2010 Schedule ICR Form online today for efficient tax management.

You will qualify for the property tax credit if: your principal residence during the year preceding the tax year at issue was in Illinois, and. you owned the residence, and. you paid property tax on your principal residence (excluding any applicable exemptions, late fees, and other charges).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.