Loading

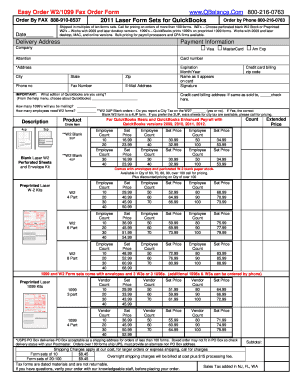

Get 1099 Misc Form 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Misc Form 2011 online

Filling out the 1099 Misc Form 2011 online can be straightforward if you follow the right steps. This guide provides clear instructions to help users navigate the form effectively, ensuring all necessary information is accurately filled out.

Follow the steps to successfully complete your 1099 Misc Form 2011 online.

- Press the ‘Get Form’ button to obtain the 1099 Misc Form 2011 and activate it in your online editor.

- Enter your name and address in the appropriate fields. This information identifies you as the payer.

- Fill in the recipient's details, including their name, address, and taxpayer identification number (TIN). Ensure accuracy to avoid processing issues.

- Indicate the type of payment made by selecting the appropriate box for the relevant income type. This may include rents, royalties, or other types of payments.

- Complete the amount paid for the tax year in the designated field. Ensure this figure is accurate as it affects the recipient's tax reporting.

- If applicable, provide any additional necessary information regarding federal income tax withheld and any other relevant details.

- Review all entries for accuracy and completeness before finalizing the document.

- Once satisfied, save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your 1099 Misc Form 2011 online today for a seamless filing experience.

Differences between 1099-MISC and 1099-NEC As of 2020, the 1099-NEC form is for all independent contractor income. The 1099-MISC is still a valid form. However, it is reserved for payments that fall outside of contractor or freelancer wages, such as rent or attorneys' fees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.