Loading

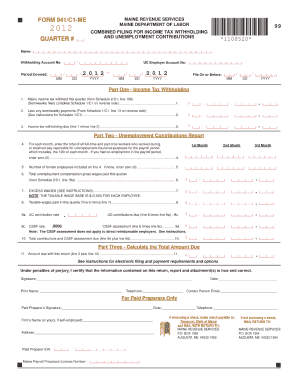

Get Form 941c1 On Line 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 941c1 On Line 2013 online

Filling out the Form 941c1 On Line 2013 online can be a straightforward process if you follow the right steps. This guide will provide you with comprehensive instructions to ensure your form is completed accurately and efficiently.

Follow the steps to successfully complete Form 941c1 On Line 2013.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- Begin by reviewing the general information section at the top of the form. Ensure that your employer identification number (EIN) is entered accurately, as this is crucial for processing your submission.

- Next, navigate to the section that requires details about your business and employment tax information. Carefully provide information related to the number of employees and the wages paid during the reporting period.

- Continue to the adjustments section where you'll need to make any necessary corrections to previously reported taxes or credits. Be clear and precise when entering these adjustments to reflect accurate amounts.

- After filling out the necessary sections, ensure that you review your entries for accuracy. This is important to avoid any potential delays or issues with your submission.

- Once you have verified your details, finalize the process by saving your changes. You will typically have options to download, print, or share the form as needed for your records.

Start preparing your Form 941c1 On Line 2013 online today to ensure timely and accurate submission!

All federal taxes can be paid using EFTPS. If you have not enrolled this system, you can need to enroll first before you can deposit payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.