Loading

Get Sr2 Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

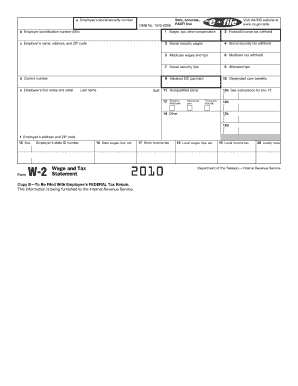

How to fill out the Sr2 Tax Form online

Filling out the Sr2 Tax Form online is a straightforward process that can help ensure your information is submitted correctly and efficiently. This guide provides clear, step-by-step instructions to assist you in completing the form, regardless of your previous experience with tax documents.

Follow the steps to complete the Sr2 Tax Form online

- Click 'Get Form' button to obtain the form and open it in the editor.

- Review the introductory section of the form to understand its purpose and any important notes that may apply specifically to you.

- Complete the personal information section by accurately entering your name, address, and contact information. Ensure that all details are correct and current.

- Proceed to fill out the income details section by providing information about your earnings, including sources and amounts. Be thorough and verify all income sources.

- Next, complete any applicable deductions or credits sections by providing necessary details that apply to your financial situation.

- Review all the information you have entered for accuracy and completeness. Make corrections where necessary.

- Once you are satisfied with the form, you can save your changes, download, print, or share the completed document as needed.

Take the next step and complete your documents online today.

Alabama is using Schedule A to determine its unemployment insurance tax rates for 2023, a state labor official told Bloomberg Tax on Jan. 5. Schedule A's tax rates for experienced employers range from 0.2% to 5.4% and include a 0.06% employment security assessment, under state law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.