Loading

Get 2012 Tennessee Inheritance Tax Return Long Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Tennessee Inheritance Tax Return Long Form online

Filling out the 2012 Tennessee Inheritance Tax Return Long Form online can be a straightforward process if you know the steps involved. This guide is designed to help you navigate each component of the form with clarity and ease.

Follow the steps to successfully complete your form.

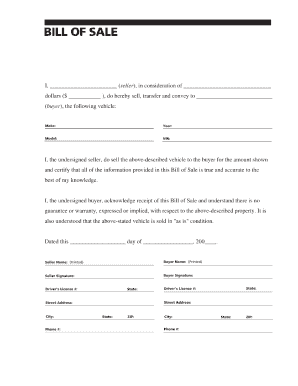

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the decedent's full name, date of death, and social security number in the designated fields. Ensure that all information is accurate and matches official records.

- Next, input the names and relationships of the beneficiaries. For each beneficiary, provide their social security number and the value of the inheritance they are receiving.

- Proceed to the section for non-probate assets, detailing any real estate, bank accounts, or personal property that may not be included in the probate estate.

- Calculate the total value of the estate by summing the values from both the probate and non-probate assets. This total will determine the tax calculation.

- Review any relevant deductions and exemptions applicable to the estate. Include these in the appropriate sections to reduce the taxable amount.

- Carefully complete the signature section, ensuring that the executor or administrator of the estate signs and dates the form as required.

- Finally, save your changes and choose to download, print, or share the completed form as needed.

Complete your forms online today for a smoother filing experience.

Tennessee does not have an estate tax. It is one of 38 states with no estate tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.