Loading

Get Ct W3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct W3 online

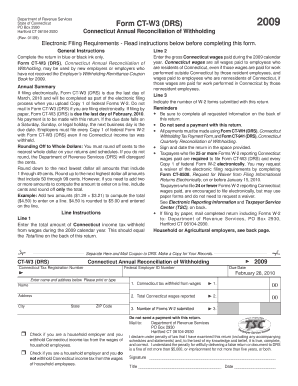

Filling out Form CT-W3, the Connecticut Annual Reconciliation of Withholding, is a crucial task for employers during tax season. This guide provides step-by-step instructions to help you accurately complete the form online.

Follow the steps to complete your CT-W3 form online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Enter your Connecticut tax registration number and federal employer ID number at the designated fields.

- Fill in your name, address, city, state, and ZIP code in the appropriate areas.

- In Line 1, input the total amount of Connecticut income tax withheld from wages during the calendar year.

- In Line 2, record the total Connecticut wages reported for the year.

- Indicate the number of W-2 forms you are submitting with this return in Line 3.

- Complete any additional requested information on the back of the return.

- Do not attach any payment; if required, ensure all payments are made using the specified forms separately.

- Sign and date the return in the designated space to affirm the accuracy of the information provided.

- Once you have completed the form, review your entries, then save, download, print, or share the document as needed.

Start completing your CT-W3 form online today for a smooth filing experience.

Step 1: Enter your personal information. In this section you'll enter your name, address, filing status and Social Security number. ... Step 2: Complete if you have multiple jobs or two earners in your household. ... Step 3: Claim Dependents. ... Step 4: Other Adjustments. ... Step 5: Sign your form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.