Loading

Get 1099me

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099me online

Filling out Form 1099me online is a straightforward process that requires careful attention to detail. This guide will walk you through each section of the form, helping you provide the necessary information accurately.

Follow the steps to complete the 1099me form with ease.

- Click the ‘Get Form’ button to access the 1099me form and prepare to complete it online.

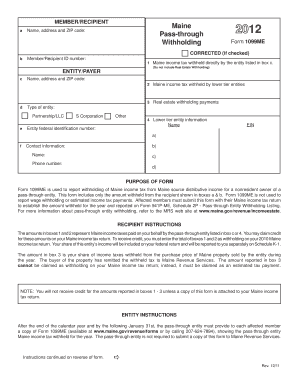

- Enter the member/recipient's name, address, and ZIP code in box a. Ensure that the information is accurate to avoid any delays in processing.

- Fill in the member/recipient ID number in the specified box identified as 'b'. This unique identifier helps in tracking and managing tax information.

- In box 1, report the amount of Maine income tax withheld directly by the entity listed in box c. Do not include any real estate withholding amounts.

- If applicable, enter in box 2 the amount of Maine income tax withheld by lower tier entities on behalf of the member. This amount should reflect the collective total from any lower tier entities.

- For box 3, if there were real estate withholding payments made during property sales, input the total amount corresponding to the member’s share.

- In box d, specify the type of entity by checking the appropriate designation for the entity's business type (e.g., partnership, S Corporation, or other).

- Enter the name and EIN (Employer Identification Number) of lower tier entities in box 4, if applicable, to ensure proper affiliation and records.

- Finally, review all information entered for accuracy, save your changes, and then choose to download, print, or share the form as required.

Get started now and complete your Form 1099me online efficiently.

Conclusion. If you run your business in Maine, you will need to pay state income tax withholding, unemployment insurance, and workers' accident compensation insurance. State unemployment insurance includes scholarships and administration fees in addition to SUTA. Some rules in Maine are stricter than in others.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.