Loading

Get Form 941c1 Me 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 941c1 Me 2015 online

This guide provides comprehensive and friendly instructions for filling out the Form 941c1 Me 2015 online. Whether you are a seasoned employer or new to the process, these step-by-step guidelines will help you navigate each section of the form with ease.

Follow the steps to fill out the Form 941c1 Me 2015 online.

- Click the ‘Get Form’ button to access the form and open it in your chosen editor.

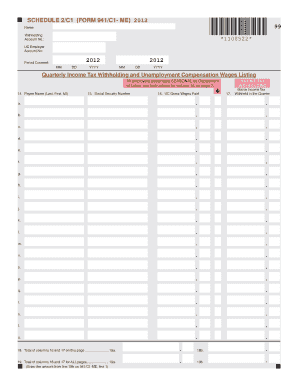

- Begin by entering the withholding account number, which is a unique identifier for your tax account.

- In the section marked 'Period Covered', specify the date range for the form submission in MM/DD/YYYY format. This is crucial to ensure your report corresponds to the correct time frame.

- In the 'Payee Name' field, provide the last name, first name, and middle initial of the employee for whom you are reporting the income tax withholding.

- Next, enter the social security number of the payee. Ensure that this number is entered correctly to prevent any processing issues.

- In the 'UC Gross Wages Paid' section, document the total gross wages paid to the employee within the specified period.

- For the 'Maine Income Tax Withheld in the Quarter' part, report the amount of income tax that was withheld from the payee's pay throughout the quarter. If there are multiple entries, fill out the respective lines from 'a' to 't'.

- Calculate the total of columns 16 and 17 on the page and enter it in the specified line (18a).

- Then, sum the totals from all pages and input that aggregate figure in line 19a, which is necessary for the final submission.

- Once all fields are completed accurately, you can save your changes, download, print, or share your completed Form 941c1 Me 2015 as needed.

Start filling out your Form 941c1 Me 2015 online today for a smooth filing experience.

You may also register electronically on the Maine Tax Portal at revenue.maine.gov, select Register a New Business. Employers or non-payroll filers registered for Maine income tax withholding must electronically file Maine quarterly tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.