Loading

Get Ct Form 1041 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct Form 1041 2011 online

Filling out the Ct Form 1041 2011 can seem daunting, but with a clear understanding of each section, the process becomes manageable. This guide will provide step-by-step instructions to help you complete the form with confidence.

Follow the steps to successfully complete Ct Form 1041 2011 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the trust or estate in the designated field at the top of the form.

- Next, input the Federal Employer Identification Number (FEIN) assigned to the trust or estate.

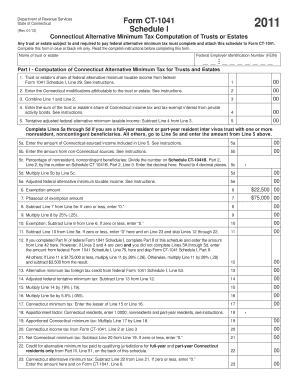

- Proceed to Part I, starting with Line 1. Enter the trust or estate’s share of federal alternative minimum taxable income from federal Form 1041 Schedule I, Line 29.

- For Line 2, include the Connecticut modifications attributable to the trust or estate. This information can typically be obtained from Schedule CT-1041B.

- On Line 3, combine the amounts from Line 1 and Line 2 to calculate the total income.

- Line 4 requires you to enter the amount of the trust or estate’s Connecticut income tax and tax-exempt interest from private activity bonds.

- Then, compute Line 5 by subtracting Line 4 from Line 3 to get the tentative adjusted federal alternative minimum taxable income.

- If applicable, complete Lines 5a through 5d. These lines pertain to full-year resident trusts with nonresident beneficiaries. Follow the instructions carefully for each calculation.

- Continue with subsequent lines, focusing on the exemption amounts, phaseouts, and any necessary multipliers specified in the instructions until you reach Line 23.

- Conclude by reviewing all the entries for accuracy, then save your changes. You may download, print, or share the form as needed.

Complete your documents online today for ease and accuracy.

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.