Loading

Get 2012 Vk 1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Vk 1 Form online

Filling out the 2012 Vk 1 Form online can seem daunting, but this guide will help you navigate each step of the process with ease. By following these detailed instructions, you will ensure that your form is completed accurately and efficiently.

Follow the steps to fill out the form smoothly.

- Click ‘Get Form’ button to obtain the form and open it in the editor. Ensure that you have a reliable internet connection for a seamless experience.

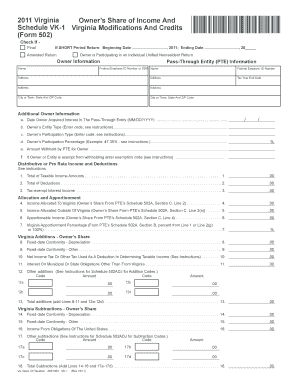

- Begin by entering your personal information in the 'Owner Information' section. This includes your name and address. Be sure that all details are accurate and clearly typed.

- In the 'Pass-Through Entity (PTE) Information' section, enter the Federal Employer ID Number or your Social Security Number, along with the PTE's name and address. Double-check the information to avoid any errors.

- Fill out the 'Additional Owner Information' section, which consists of several fields including the date you acquired interest in the PTE, your entity type, participation type, percentage, and any withholding amount by the PTE.

- For the 'Distributive or Pro Rata Income and Deductions' section, input the total taxable income amounts, total deductions, and tax-exempt interest income. Follow the provided instructions on the form to ensure calculated amounts are correct.

- In the 'Allocation and Apportionment' section, provide details regarding income allocated to Virginia, outside of Virginia, and the apportionable income—refer to the associated schedules for these values.

- Complete the 'Virginia Additions - Owner’s Share' and 'Virginia Subtractions - Owner’s Share' sections, ensuring you accurately enter any related amounts based on the guidelines.

- Proceed to fill in any tax credits applicable to you in the 'Virginia Tax Credits' section. This includes both nonrefundable and refundable credits—double-check for any codes or exemptions you may qualify for as outlined in the instructions.

- After filling all necessary sections, review the entire form to ensure all fields are completed correctly and that there are no missing information or errors.

- Finally, save changes, download, print, or share the completed form as needed. Make sure to keep a copy for your records.

Start your filling process online today to complete your 2012 Vk 1 Form effortlessly.

Unless you have established residency in another state, you will still be considered a domiciliary resident of Virginia, and will be required to file Virginia income tax returns. A domiciliary resident of Virginia is one whose legal domicile in the technical sense is in Virginia.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.