Loading

Get Form St 44

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form St 44 online

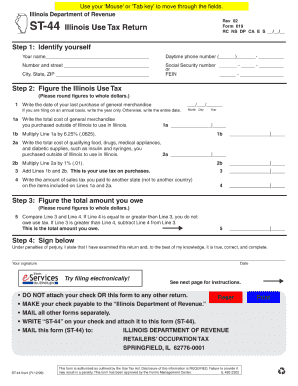

Filling out Form St 44 online is a straightforward process that allows users to submit their information efficiently. This guide provides a clear, step-by-step approach to help you understand each component of the form and ensure accurate completion.

Follow the steps to complete the Form St 44 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields, including your full name, address, and contact details. Ensure that all provided information is accurate and up to date.

- Next, proceed to fill out the specific sections regarding your financial information. This may include income sources and other relevant financial data necessary for the form's purpose.

- Follow with providing any additional required details. This may involve answering specific questions or entering information related to your eligibility or circumstances pertinent to the form.

- Review the completed information for any errors or omissions. Make sure all sections are filled out correctly to avoid delays in processing.

- Once satisfied with your entries, choose to save your changes, download the completed form as a PDF, print it for your records, or share it as needed.

Start filling out the Form St 44 online today for a smooth and efficient experience.

The state-wide sales tax in Illinois is 6.25%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.