Loading

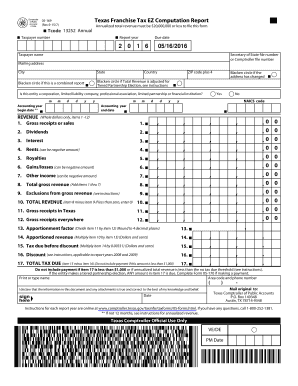

Get Annualized Total Revenue Must Be $20,000,000 Or Less To File This Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annualized Total Revenue Must Be $20,000,000 Or Less To File This Form online

Filling out the Annualized Total Revenue Must Be $20,000,000 Or Less To File This Form online is a straightforward process. This guide will equip you with the necessary steps to complete your form accurately, ensuring compliance with filing requirements.

Follow the steps to complete your form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer number. This number is essential for processing your form and must be accurate.

- Indicate the report year by entering the appropriate year in the designated field.

- Fill in your taxpayer name and ensure you include your Secretary of State file number or Comptroller file number if applicable.

- Complete your mailing address, including city, state, country, and ZIP code plus 4 to ensure correct correspondence.

- Blacken the circle if you are filing a combined report or if your total revenue is adjusted for a Tiered Partnership Election.

- Specify the type of entity you are by indicating if it is a corporation, limited liability company, professional association, limited partnership, or financial institution.

- Input the accounting year begin date and end date, ensuring you follow the format required.

- Complete the NAICS code section, which helps classify the industry of your entity for assessment purposes.

- Report your revenue figures in whole dollars by filling in items 1 through 7 accurately.

- Calculate and enter your total gross revenue by adding items 1 through 7.

- Document any exclusions from gross revenue as per the provided instructions.

- Compute your total revenue by subtracting exclusions from the total gross revenue, entering zero if the result is less than zero.

- Fill out the gross receipts in Texas and gross receipts everywhere fields.

- Calculate the apportionment factor and the apportioned revenue as instructed in the form.

- Determine the tax due before discounts and any eligible discounts based on the year of the report.

- Complete the total tax due calculation and ensure not to include payment if the amount is less than $1,000.

- Print or type your name, enter your area code and phone number, and declare the information is true to the best of your knowledge.

- Finally, save your changes, and consider downloading, printing, or sharing the completed form as necessary.

Ensure your compliance and convenience by completing your forms online today.

The following entities do not file or pay franchise tax: sole proprietorships (except for single member LLCs);

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.